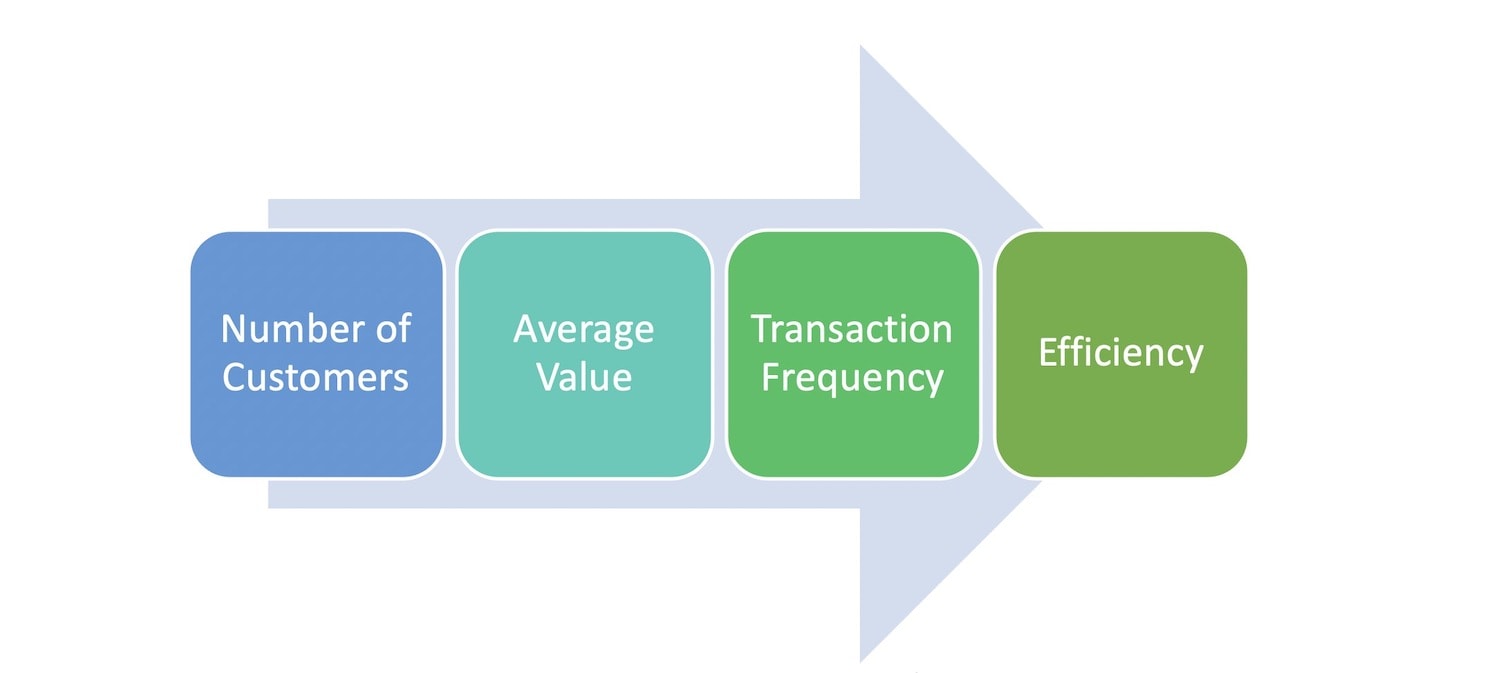

“Four ways to grow your business:

1. Increase the number of customers (of the type you want)

2. Increase the average transaction value

3. Increase transaction frequency

4. Improve efficiency.”

– Phil Symchych

Sources: Attributed to various sources including Results Accountants Systems.

Accountants, unfortunately, group all of the action in your business into a single line on the financial statements called Revenue. Let’s unbundle that Revenue line and look at what really matters in your business.

Many decades ago, during my first training as a consultant, I was exposed to the brilliant model on “The Four Ways to Grow your Business.” This was simply the best advice I received on how to advise small/medium enterprises—in any industry—on how to grow their business.

Figure 74.1: Four ways to grow your business

Simple, yes. Powerful, yes. Easy, almost yes. When you have the data, you can make better decisions and measure results. That’s the formula for making things easier.

In the decades since, I’ve helped more than 120 companies to grow their business by implementing this advice. We measure, analyze, develop strategies, measure some more, adjust strategies, and keep measuring and adjusting until we hit the sweet spots for success. It takes patience, persistence, and data. More on that later.

The four ways to grow your business will be discussed in greater detail in future issues. This especially applies to business-to-business mid-market companies during a pandemic, economic downturn, or boom times. During any times, in fact.

Here are some tips to get you thinking about your business and prepare you to analyze your business and develop actionable strategies in the future. (See my offer below.)

But first, let’s figure out the numbers, otherwise we’re guessing. There is no place for guessing in business when you are sitting on top of the data you need to make better decisions.

The numbers:

- Number of customers – do you measure how many customers or clients you’ve helped in the last 12 months? Specifically, how many new customers you’ve obtained, where they came from, how many left, and why they left? Too many businesses spend too much time and money trying to attract new customers instead of retaining and delighting the ones they already have acquired.

- Average transaction value – simply take your total revenues for the year or last 12 months and divide by the number of invoices (that is, transactions) you’ve issued to calculate your average transaction value. You can do this by product or service line or geography or division, as well.

- Transaction frequency – divide your total number of transactions or invoices by how many customers you have to determine the transaction frequency.

- Efficiency can be measured may different ways. One way is to take your total selling, general, and administrative expenses and divide by the number of transactions you have. This will give you your cost per transaction. Another way is to take your net profit and divide by your number of transactions to give you the profit per transaction.

When you do this, or if you need, help, call me. You’ll have a powerful foundation to start growing your business in a more strategic and more profitable manner. This will build your business wealth.

“The purpose of a business is to serve a customer.”

—Peter Drucker

And…

“The purpose of growing your business is to serve more customers and to build your business wealth.”

–Phil Symchych

How do you measure how many customers you have, average transaction value, transaction frequency, and efficiency in your business? Let me know by email.

Full speed ahead!

Thanks for reading.