Astronaut Richard Hadfield, former commander of the International Space Station, talked about a rocket’s launch velocity during his MasterClass presentation. He said that there is an optimal launch velocity to get the rocket into orbit. Going too fast is not good because it creates more friction that you need to overcome by burning more fuel. Faster isn’t better.

Does this sound familiar? Many high growth companies are burning so much cash that they try and go faster to generate more cash. But going faster needs even more cash. We don’t call it a ‘burn rate’ by accident.

Eventually, meaning sooner rather than later, high growth firms can run out of cash, even though they are profitable, have a growing brand, lots of customer orders, and lots of enthusiasm.

There is one main factor for not running out of cash and getting your high growth business into orbit.

You need a plan.

As a wise friend and successful entrepreneur commented after reading the last issue, the business plan is not for the bankers. The business plan is for the business, regardless of any borrowing need. Bankers ask to see a copy of the plans. If you’re writing a business plan solely for the banker, you’re missing the point of the business plan.

The same wisdom applies to a cash flow plan.

The Cash Flow Plan

I’ve never met an entrepreneur who loved making cash flow plans. However, I’ve met lots of (now converted) entrepreneurs who ignored the cash flow plan, ran out of cash even though they were profitable, and realized there was more to growing the business than generating more sales. They learned that cash isn’t king, it’s the ace!

High growth companies, not unlike companies in distress, need to monitor their cash daily and weekly. If high growth companies don’t monitor and control their cash, they will soon be in distress. That’s the connection.

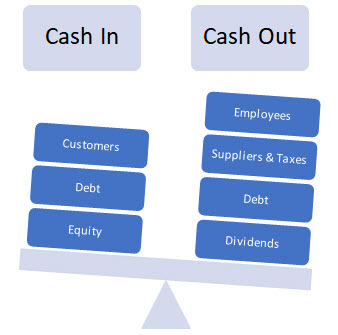

Cash comes in and it goes out. The key factor in cash flow is to accelerate the inflows as much as possible while controlling the outflows. Fast cash in. Smart cash out.

Figure 20.1: Cash In and Out

Cash Inflow Tips

Here are ten tips to accelerate cash inflow:

- Cash formula: Profit Margin x Sales Volume x Speed of Payment. Focus on all three factors.

- Ask customers for deposits and payments up front.

- Offer discounts for early payments.

- Aggressively monitor your accounts receivable.

- Boldly negotiate with your customers for better payment terms on projects and contracts.

- Be ruthless when payment terms are not met.

- Balance your inflows with good debt.

- Don’t minimize taxes. Maximize after-tax wealth.

- Retain earnings in the business so you can strengthen your balance sheet and attract good debt. That’s an easy two-to-one return on investment.

- Think and act like a large company that pays regular dividends to its shareholders. This helps to focus you on cash flow and builds discipline in all your business dealings.

How do you control your cash flow while optimizing your burn rate for efficient acceleration in your business?