Welcome to this new version of my business growth tips where I share strategies, tactics, ideas, successes, and some failures, to help you grow your business.

“Leaders need real numbers – strategy, sales, operations, and finance – to make better decisions and improve business performance..” — Phil Symchych

I know you’re busy! The Executive Summary is a one minute read. Full article is a seven minute read.

Executive Summary

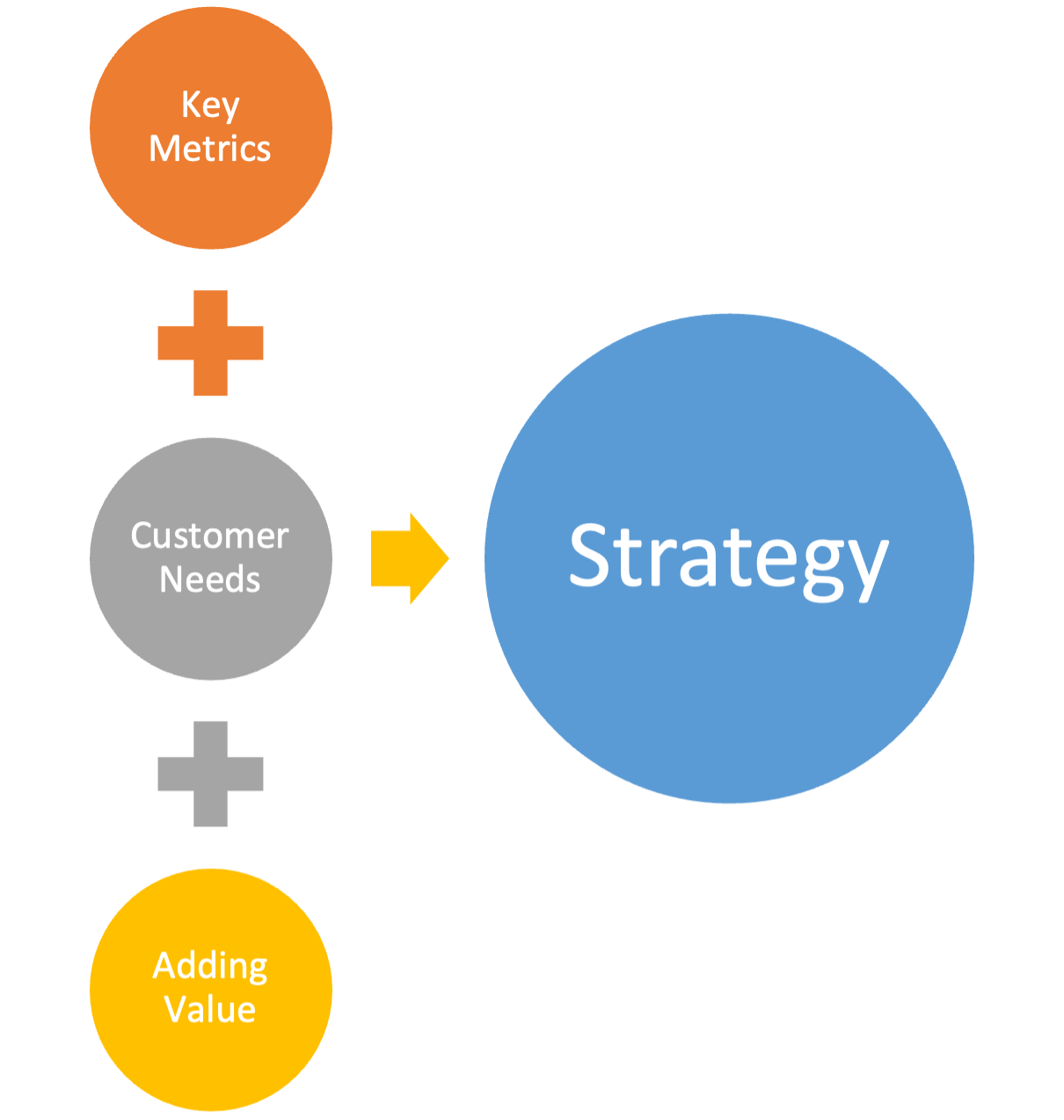

Spring cleaning your business strategy involves analyzing key metrics, assessing customer needs, and identifying how you do or can add value. This article discusses reviewing key metrics, ideally every quarter.

- Strategic measures: growth, innovation, efficiency, speed, customer impact.

- Sales metrics on actual units or projects and dollars sold.

- Operational metrics for actual units or hours or value produced.

- Financial metrics including key balance sheet and income statement data, trends, ratios.

- Comparing actual performance to budgets and identifying causes of success (so you can replicate them) or negative variance (so you can fix them).

Call me or reply to this email if you’d like to schedule a complimentary 20-minute session to discuss your company’s strategic metrics. I promise I won’t try to sell you anything!

The Full Story

In Canada, we benefit from very distinct seasons, and pay for that privilege with pretty darn cold winters. It’s great to finally open the windows and hear the birds singing. As the spring rains wash away winter and turn the grass green, we are all getting rid of winter boots and parkas and preparing for spring.

Although a business has a formal year end once a year, it’s more effective to review performance, and especially strategic initiatives, more often than once a year.

The days of five-year strategic plans are long gone. It takes a continual oversight of your business strategy to see what’s working and what isn’t to optimize your business performance and growth.

There are three key factors for reviewing your strategy every quarter so you can adjust in real time. The three factors are:

- Key metrics

- Customer needs

- Value added

One place to start your business spring cleaning is on the metrics you are or aren’t tracking in your business.

In this article, we will talk about the key metrics for measuring your strategy on a regular basis. We’ll discuss the other factors in a future article, so stay tuned.

This review process can also be used to measure business units within your company on a more frequent and/or detailed basis. That way, the business unit metrics can be combined up to measure overall business performance.

In fact, if you are using Flash metrics in your business, you’re probably reviewing key performance results every week. This process fits beautifully into the Flash process.

The key factors include real time metrics that measure actual sales and operational performance as well as the typical historical financial data.

You need real numbers – strategy, sales, operations, and finance – to make better decisions that will improve business performance.

If you can’t measure progress on your strategic initiatives, how will you know when you’re successful? Many businesses I’ve helped were initially focused only on basic financial data (because that’s all they had) and not at all focused on measuring strategy, often because they didn’t have the right (or any) strategic metrics in place.

One organization I’ve worked with had three major strategic priorities in place. Some were measurable, some were vague. Complicating this were the 27 strategic initiatives stated under the three priorities. Those were challenging to measure, there were way too many of them, and they were more of a wish list of future nice to haves.

That’s what happens when facilitators go crazy with the flipcharts in a strategy session.

Business owners don’t need facilitators, they need results. And results come from focusing on the very few top strategic priorities that will move the needle for customer satisfaction and financial results.

If you’re a business owner and want help developing your strategic metrics, give me a call or send an email, and we’ll have a complimentary 20-minute session to talk about your business strategy (and I promise I won’t try to sell you anything).

Another common problem is only using historical financial statements to review business performance. Is this you? Financial statements only tell the (historical / financial) version of the story in your business. You’re missing out on analyzing most of the lead indicators of sales and production that create those lagging indicators on your financial statements.

Key questions:

- How are you measuring your major strategic initiatives? If your goal is growth, is it simply top line revenue growth, or does profitability matter, too? If your goal is to improve efficiency, how are you performing? If your goal is to innovate, how are you adding value – and ideally measurable value – to your ideal customer? Your metrics need to show – accurately and in real time – how your business is performing on its strategic priorities.

- How much did you sell in the last quarter? How many units and dollars and projects? This is confirmed with signed contracts and purchase orders, not just projecting on a future pipeline.

- How much did you produce in the last quarter? This is easier to determine if you measure it daily and add up the numbers. It can be measured in units, square feet, billable hours, number of customers served, or whatever key activity your employees do every day to take care of your customers and clients.

- What is your financial position and performance?

- The position is shown from key ratios on your balance sheet such as days sales sitting in accounts receivables, aging of accounts receivable and payable, working capital, cash flow, debt to equity.

- The performance is shown on your income statement. It is never just total sales. More important is the profit you generate on those sales. That includes gross profit in dollars and gross margin by percentage, ideally by product or service line and by customer. Most companies have this information – or can get it – out of their accounting system, but often don’t…because no one asked the accounting department to do this.

- Another critical piece to analyzing financial and business performance is comparing actual to budget both horizontally on a line-item basis and vertically as a percentage of sales. This analysis will quickly show if certain expenses are growing faster than revenues, one of the most common causes of decreasing profit and tightening cash flows.

Spring cleaning your business strategy needs to start with ensuring you’re measuring the right activities in the right way. With better information, you’ll make better decisions and that will drive better results.

Full speed ahead!

Thanks for reading.

Phil