Entrepreneurs and business owners are the modern-day heroes in our economy.

However, they don’t have a government pension. They don’t get two months off in the summer. They aren’t guaranteed a paycheque. They sign unlimited personal guarantees to the banks. They take risks that most people are unaware of and unequipped to handle. But it’s all part of a normal day for an entrepreneur.

Globally, entrepreneurs support 54% of the gross domestic product in the top 17 economies, according to the World Bank. They create the most net new jobs. And they employ a lot of people that enhance the quality of our lives.

To help my clients and entrepreneurs, and owners of mid-market companies everywhere, I recommend they develop structures that enhance the creation and protection of their business wealth. Because, if they don’t, they could lose everything.

As always, consult with qualified professionals including financial planners, accountants, lawyers, and tax advisors to ensure your structure is optimized for your unique situation and your goals. Be careful when using advisors who are not compensated directly by you and only receive commissions from products they sell. When in doubt, take a commissioned advisor’s advice to an independent professional for assessment.

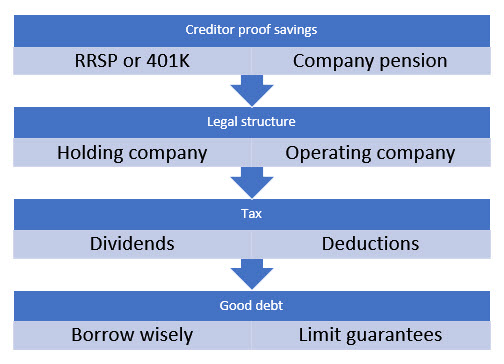

Figure 32.1 Structures to Create and Protect Business Wealth

Savings and Pensions

First, pay yourself first. We can all take advantage of government supported savings programs like Registered Retirement Savings Plans, or RRSPs in Canada, and 401Ks in the US. In Canada, RRSPs are protected from business and personal creditors. If you’re not maximizing your RRSP savings or other type of company pensions, then you’re not optimizing your wealth.

Legal Structures

Second, utilize legal structures that allow you to hold assets in one company, such as a holding company that owns the land and buildings necessary for your business. Then, your operating company pays fair market value rent to your holding company. Your holding company can be a long-term revenue stream from rental revenue, even if you sell your operating company or move it to a different location. This also protects the assets in the holding company from actions of unhappy people who deal with the operating company.

Tax Efficiency

Third, develop tax efficiency among the entities in order to maximize your after-tax cash flow and build your wealth. Tax efficiency includes the use of dividends between companies and to shareholders (by class of shares held), income splitting using fair market value salaries, and many other fine points of tax planning and legitimate deductions beyond the scope of this article.

Do not minimize your taxes in your operating company. This is a common and serious mistake that is advised by many short-sighted accountants.

Minimizing taxes hurts your operating company’s balance sheet because you don’t build up equity in the form of retained earnings. A lack of retained earnings limits how much you can borrow to fund and accelerate growth. That hurts your wealth. I’ve calculated that paying taxes can, with an inventory turnover of four times and a gross margin of 40%, generate an ROI of over 1,000% to your wealth.

If you’re planning on selling your business, you need to have a proper tax structure in place for at least two years, or you could lose out on the capital gains exemption and pay hundreds of thousands of dollars in tax, unnecessarily.

Good Debt and Security

Finally, borrow wisely. When you’re a small business (under ten million dollars in annual revenues), the bankers will demand that you sign unlimited personal guarantees as security. That’s because often the business lacks the retained earnings and stable cash flows to give high levels of comfort, so the bank improves their security position by taking everything you own as backup collateral. That’s normal and often unavoidable when you’re a small business.

The goal is to provide only enough security for the borrowing, and no more. Mid-market companies often grow beyond the capacity of a personal guarantee and the company can support the debt. That’s a good thing.

Always protect yourself first. That’s the only way you will be able to grow and control your future. Otherwise, everyone else will take as much as they can get and you might be left with nothing, despite taking the most risks.